Learn about Business Electricity

The Business Electricity Landscape: Why It Matters and What You’ll Learn

Before diving into formulas, meters, and tariffs, it helps to see the big picture. For many organizations, electricity is both a major operating expense and a lever for performance. In energy‑intensive sectors, electricity can approach double‑digit percentages of total operating costs, while in lighter commercial settings it still shapes margins, comfort, and uptime. The right decisions here ripple across cash flow, customer experience, and brand reputation. To set the stage, here is the outline guiding this article:

– The landscape and why electricity decisions matter for costs, resilience, and reputation

– Tariffs, contracts, and bill anatomy that determine what you actually pay

– Procurement strategies and risk management for budget certainty

– Efficiency, demand management, and electrification of key processes

– Sustainability, renewables, compliance, and a practical conclusion for decision‑makers

Electricity spending is not one single line item; it is the end point of many choices: when your facility uses power, how sharply it peaks, which contract structure you sign, how well equipment is maintained, and what backup and on‑site resources you deploy. In many markets, bills combine energy charges based on kilowatt‑hours with demand‑related fees based on peak kilowatts over an interval. That means a brief surge in load can cost far more than an hour of steady operation at a lower level. Likewise, policy and network charges can be a sizable share of the bill, so focusing only on price per kilowatt‑hour misses the full picture.

The upside is significant. Businesses that manage demand, optimize run‑schedules, and right‑size contracts often cut overall electricity costs by meaningful percentages without compromising output. Real‑world examples include staggering process start‑ups to flatten peaks, adding controls to slow fans or pumps when full speed is unnecessary, and using on‑site storage to shave the priciest minutes of use. The goal is not only to pay less, but to transform electricity from a volatile expense into a stable platform for growth. Over the next sections, we unpack the tools to do that—clearly, practically, and with enough detail to help you act with confidence.

Tariffs, Contracts, and the Bill: Understanding What You’re Really Paying For

Every invoice tells a story. To read it well, you need to separate the strands: energy consumption, demand, network costs, policy components, and taxes. The energy portion typically charges for kilowatt‑hours used and may be split across time bands such as peak, shoulder, and off‑peak. The demand portion is often based on the highest 15‑ or 30‑minute average kilowatts recorded in the billing period, though some tariffs use longer look‑backs or seasonal ratchets. Add to that distribution and transmission fees, system balancing costs, metering charges, and mandated programs, and the price on your contract headline is only part of the total.

– Energy charge: price per kilowatt‑hour, sometimes varying by time‑of‑use

– Demand charge: fee based on your maximum interval load, often a large cost driver

– Network and policy charges: grid upkeep, capacity obligations, and compliance costs

– Metering and service fees: fixed daily or monthly amounts independent of consumption

Contract structures shape risk and budget certainty. A fixed‑price agreement can shield you from wholesale price swings, simplifying forecasting, yet may trade flexibility for stability. An indexed contract moves with the market and can yield savings during low‑price periods, but exposes you to spikes. Hybrid structures exist too, such as block‑and‑index deals where a portion of expected load is fixed while the remainder floats. Consider also the term length: shorter terms allow frequent renegotiation, while multi‑year terms can lock in attractive levels when markets are favorable. The fine print matters—volume tolerances, change‑of‑use provisions, and pass‑through clauses determine whether your invoice matches expectations when operations shift.

Bill anatomy offers insight for action. If demand charges account for an outsized share—commonly 20–60% in some tariffs—targeting peak reduction may deliver faster returns than chasing a small discount on energy rates. Interval data from smart meters can reveal whether a single daily surge is setting your monthly peak or if multiple moderate peaks are at play. For example, a short, simultaneous start of compressors, HVAC, and process heaters can create a sharp spike; sequencing those loads by a few minutes or adding soft‑start controls can lower the recorded maximum. By understanding how your bill is built, you can choose interventions that move the needle where it counts.

Procurement and Risk Management: From Price Taking to Price Shaping

Buying electricity is part finance, part operations, and part forecasting. Since you cannot stockpile electrons in a warehouse, procurement is about aligning contract structures with operational realities and risk appetite. The goal is to convert uncertain, volatile inputs into predictable, well‑managed costs that support strategy. While no one can predict markets perfectly, there are disciplined ways to manage exposure and improve outcomes.

– Fixed price: budget stability, straightforward reporting, less benefit from market dips

– Indexed price: potential savings in low markets, higher exposure to spikes

– Hybrid approaches: fix base load, float variable load; add caps or collars for protection

– Term strategy: laddered maturities to avoid “all‑at‑once” renewal risk

A practical approach is to estimate your “firm” base load—the portion that runs regardless of season or output—and your “variable” load driven by production cycles. Many organizations fix a high share of the base load for 12–36 months while leaving the variable slice partially indexed to capture favorable pricing when it appears. Some spread purchases over time (often called layering or laddering) to average costs and reduce the impact of timing errors. Building decision rules—such as target price thresholds, maximum unfixed percentages, and renewal lead times—prevents ad‑hoc choices under pressure.

Volume risk deserves attention. If a contract penalizes significant deviations from forecast, cost surprises can emerge when operations grow or contract. Negotiating tolerances or choosing a structure that allows reasonable swings can reduce that risk. Likewise, delivery terms such as start dates, credit requirements, and settlement mechanics influence total cost. Procurers who coordinate with operations, maintenance, and finance can anticipate changes—new equipment, shift patterns, or facility expansions—and choose terms accordingly.

Finally, do not overlook non‑price value. Reliable billing data access, interval data granularity, and responsive customer support influence your ability to manage usage in real time. Clear, auditable reporting helps finance teams reconcile costs and supports sustainability disclosures. Procurement is most effective when it is continuous rather than a once‑every‑few‑years event: monitor markets, review performance quarterly, and keep options open for opportunistic adjustments within the bounds of your risk policy.

Efficiency, Demand Management, and Electrification: Doing More with Every Kilowatt

Lowering unit prices is helpful, but lowering the number of expensive units you buy—and when you buy them—often delivers larger, more durable gains. Efficiency and demand management tackle both sides. Efficiency reduces kilowatt‑hours per unit of output, while demand management flattens peaks that trigger high charges. Together, they shape a gentler load profile that costs less and causes fewer surprises.

– Audit and measure: establish baselines using interval data and sub‑metering

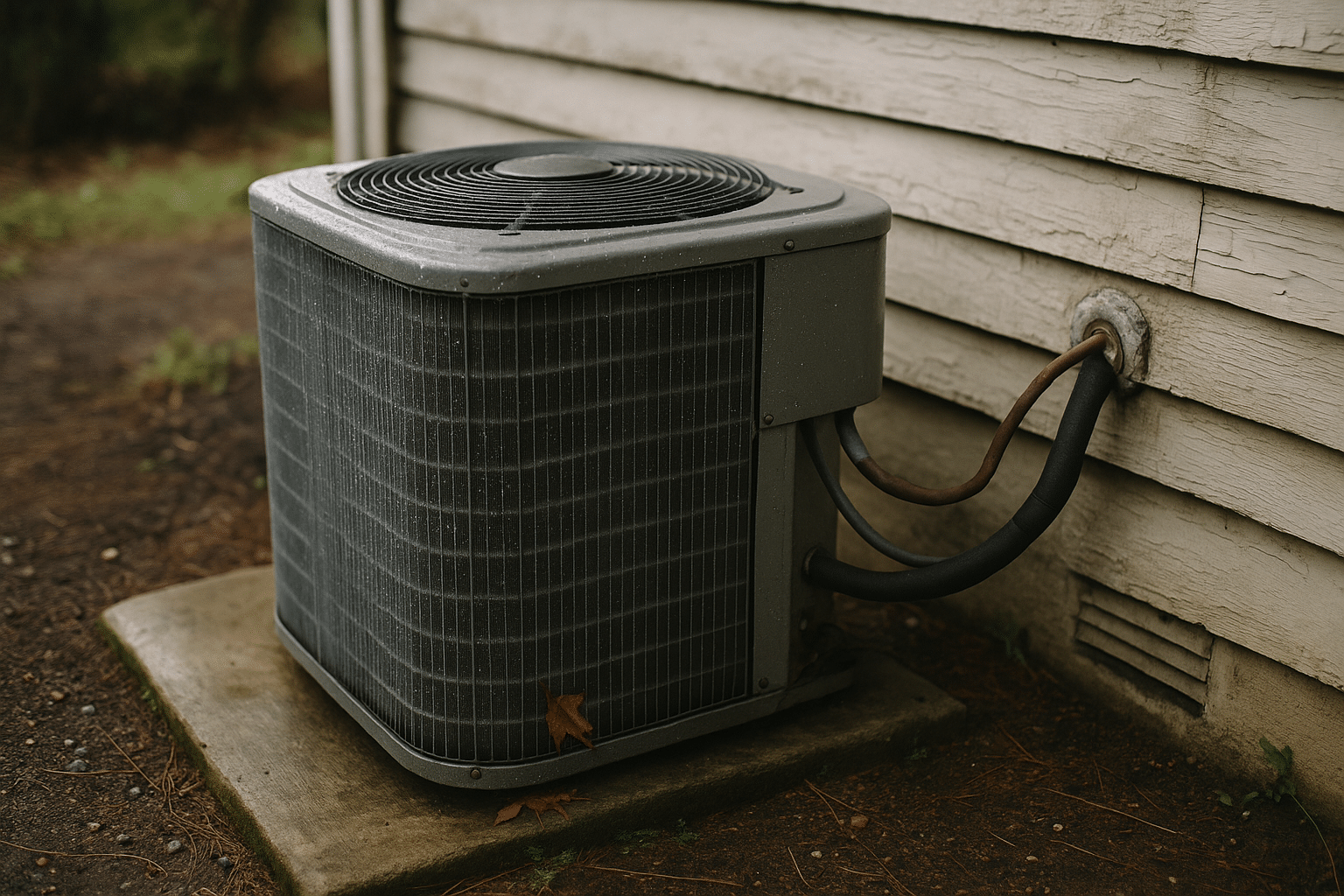

– Target the big loads: HVAC, refrigeration, compressed air, process heat, motors

– Control and sequence: avoid simultaneous starts and oversizing; apply setpoint discipline

– Maintain relentlessly: dirty filters, leaks, and misaligned belts are silent cost drivers

Start with data. Many facilities discover that a small number of loads dominate consumption. Motors running at full speed against throttled valves, refrigeration systems short‑cycling, or a compressed air network with leaks can waste double‑digit percentages of energy. Variable speed drives, improved insulation, and heat recovery on process exhaust can deliver meaningful savings with reasonable paybacks. In lighting and HVAC, controls matter as much as hardware: occupancy‑based scheduling, optimized temperature deadbands, and night setback strategies reduce run hours without affecting comfort or quality.

Demand charges require a slightly different playbook. Identify the intervals that set your monthly peak and the equipment operating at those times. Simple steps—staggering start‑ups, using soft‑starts for large motors, or pre‑heating/pre‑cooling before peak periods—can compress peaks. Thermal storage and battery systems can shift energy consumption away from expensive windows, shaving high‑cost minutes. In some regions, participation in demand response programs yields incentives for trimming load during grid stress, turning flexibility into revenue while supporting reliability.

Electrification adds a new layer. As businesses replace combustion equipment with electric alternatives for process heat or fleets, careful planning avoids creating new peaks. Managed charging for vehicles—favoring off‑peak hours and dynamically adjusting rates—keeps demand flat. When combined with on‑site generation and storage, electrification can improve overall efficiency and resilience. The hallmark of a mature program is iteration: measure, adjust, and lock in gains through standard operating procedures so savings persist even as teams and seasons change.

Sustainability, Renewables, Compliance—and a Practical Conclusion for Decision‑Makers

Electricity choices now shape not only cost but also carbon exposure and compliance. Many organizations track market‑based and location‑based emissions from purchased electricity, setting targets that influence procurement and project selection. Options to decarbonize include buying verified renewable certificates, contracting for renewable generation through long‑term agreements, and installing on‑site systems such as rooftop solar paired with storage. Each path balances economics, visibility, and operational control.

– Certificates: flexible, book‑and‑claim approach; simple to scale; price varies by attributes

– Long‑term agreements: price certainty and additionality; require diligence and risk oversight

– On‑site generation: direct control and resilience; depends on site conditions and load shape

– Storage and controls: improve self‑consumption and peak shaving; enhance reliability

Compliance and disclosure are evolving. Reporting frameworks increasingly ask for granular energy data, progress against targets, and risk assessments for price and supply volatility. That makes metering, data quality, and governance more than a back‑office exercise—they are prerequisites for credible claims and stakeholder trust. Policies in many markets also reward demand flexibility and penalize unmanaged peaks, further aligning good operations with good compliance.

Resilience is another dividend. On‑site generation and storage can keep core loads running during outages, safeguarding safety, data integrity, and customer commitments. Even modest systems sized to support critical functions can prevent costly downtime. The key is to map loads by priority—life safety, revenue‑critical, and comfort—and design pathways that maintain the essentials under plausible scenarios.

Conclusion: A Business‑Focused Summary

For decision‑makers, the path forward is clear and actionable: understand your bill drivers, choose procurement that matches your risk appetite, flatten peaks through targeted operations, and align electricity use with sustainability and resilience goals. Start with interval data and a ranked list of opportunities; sequence low‑cost operational fixes ahead of capital projects; and lock in gains with routines and accountability. Do this well, and electricity shifts from a volatile cost to a disciplined advantage—quiet, reliable, and tuned to your strategy.